Debt To Equity Ratio What Is It, Formula, Importance

In contrast, service companies usually have lower D/E ratios because they do not need as much money to finance their operations. A lower D/E ratio suggests the opposite – that the company is using less debt and is funded more by shareholder equity. On the other hand, when a company sells equity, it gives up a portion of its ownership stake in the business. The investor will then participate in the company’s profits (or losses) and will expect to receive a return on their investment for as long as they hold the stock. Debt financing is often seen as less risky than equity financing because the company does not have to give up any ownership stake. There are various companies that rely on debt financing to grow their business.

Debt To Equity Ratio Vs Current Ratio

Company B, on the other hand, has total liabilities of $200,000 and shareholder’s equity of $800,000. Company A has total liabilities of $500,000 and shareholder’s equity of $250,000. The debt-to-equity ratio is important because it gauges how healthy the relationship in the business is between debt and equity, and expresses the capacity of a business to raise financing for growth.

- Therefore, it’s often necessary to conduct additional analysis to accurately assess how much a company depends on debt.

- In the majority of cases, a negative D/E ratio is considered a risky sign, and the company might be at risk of bankruptcy.

- It’s important to analyse the company’s financial statements, cash flows and other ratios to understand the company’s financial situation.

- The D/E ratio indicates how reliant a company is on debt to finance its operations.

- The concept of a “good” D/E ratio is subjective and can vary significantly from one industry to another.

What is the Debt to Equity Ratio Formula?

These assets include cash and cash equivalents, marketable securities, and net accounts receivable. Utilities and financial services typically have the highest D/E ratios, while service industries have the lowest. Generally, a D/E ratio of more than 1.0 suggests that a company has more debt than assets, while a D/E ratio of less than 1.0 means that a company has more assets than debt. So in the case of deciding whether to invest in IPO stock, it’s important for investors to consider debt when deciding whether they want to buy IPO stock.

Step 1: Identify Total Debt

For example, capital-intensive companies such as utilities and manufacturers tend to have higher D/E ratios than other companies. The debt-to-equity ratio is one of the most important financial ratios that companies use to assess their financial health. It provides insights into a company’s leverage, which is the amount of debt a company has relative to its equity.

Example 4: Company D

For example, preferred stock is sometimes included as equity, but it has certain properties that can also make it seem a lot like debt. Specifically, preferred stock with dividend payment included as part of the stock agreement can cause the stock to take on some characteristics of debt, since the company has to pay dividends in the future. Many startups make high use of leverage to grow, and even plan to use the proceeds of an initial public offering, or IPO, to pay down their debt. The results of their IPO will determine their debt-to-equity ratio, as investors put a value on the company’s equity. Having to make high debt payments can leave companies with less cash on hand to pay for growth, which can also hurt the company and shareholders.

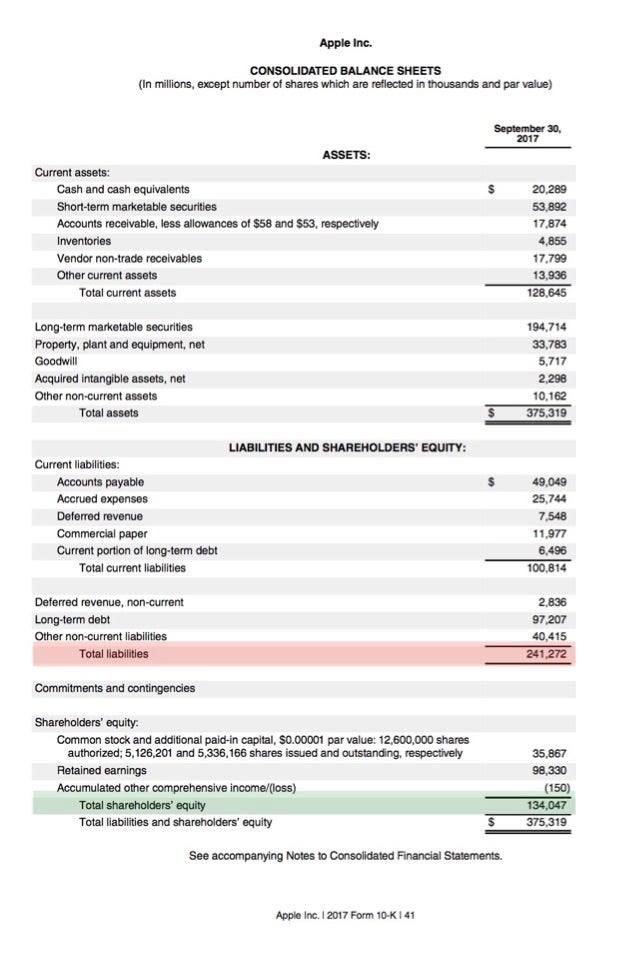

It reflects the relative proportions of debt and equity a company uses to finance its assets and operations. This number represents the residual interest in the company’s assets after deducting liabilities. The data required to compute the debt-to-equity (D/E) ratio is typically available on a publicly traded company’s balance sheet. However, these balance sheet items might include elements that are not traditionally classified as debt or equity, such as loans or assets. A lower debt-to-equity ratio means that investors (stockholders) fund more of the company’s assets than creditors (e.g., bank loans) do. It is usually preferred by prospective investors because a low D/E ratio usually indicates a financially stable, well-performing business.

But if it’s particularly higher or lower than that industry standard, it might be worth interrogating your finances further – particularly if you’re looking for investment. However, it is important to note that financial leverage can increase a company’s profits by allowing it to invest in growth opportunities with borrowed money. So, a company with low debt-to-equity ratio may be missing out on the potential to increase profits through financial leverage. A low debt-to-equity ratio does not necessarily indicate that a company is not taking advantage of the increased profits that financial leverage can bring.

If both companies have $1.5 million in shareholder equity, then they both have a D/E ratio of 1. On the surface, the risk from leverage is identical, but in reality, the second company is riskier. The result means that Apple had $3.77 of vertical analysis of income statement debt for every dollar of equity. It’s important to compare the ratio with that of other similar companies. Let’s consider Company D, which has total liabilities of $3,000,000 and shareholder’s equity of $1,000,000.